Smart Strategies to Reduce Your Capital Gains Tax

If you’ve recently sold investments or are considering doing so, you might be thinking about the tax implications. Being concerned about capital gains taxes is actually a good problem to have because it means your investments paid off! Whether by smart planning or a bit of luck, your portfolio has grown, and now you’re reaping the rewards.

Of course, with those gains comes a tax obligation. While taxes are inevitable, there are legal strategies to help reduce what you owe. Here are four practical tips to keep the IRS from taking too big a slice of your capital gains.

1. Wait a Little Longer to Sell

Timing the sale of your investments is critical to lowering your capital gains taxes. Selling your shares after holding for less than a year will result in a short-term capital gains tax. This means all the gains you made from the sale of the stock will be taxed at your ordinary income rate, which can be 32%-37% for high-earners. Holding on to an asset for more than one year will be taxed at the long-term capital gains tax rate, which can be 0%, 15%, or 20%.

Holding periods are also critical when it comes to the sale of real estate. If you sell your primary home and you lived in the home for at least two years of the five-year period before the sale, the IRS allows you to exclude the first $250,000 of capital gains (or $500,000 for a married couple filing jointly). While the capital gains exclusions do not apply to investment properties, you may be able to utilize like-kind exchanges to defer capital gains tax by reinvesting in other real estate.

2. Utilize Tax-Loss Harvesting (TLH)

Losing money on your investments is usually a bad thing, but utilizing a tax-loss harvesting strategy means you can claim capital losses to offset your capital gains. If you show a net capital loss, you can use the loss to reduce your ordinary income by up to $3,000 (or $1,500 if you are married and filing separately). Losses above the IRS limit can be carried over to future years. Sometimes it is advantageous to sell depreciated assets for this reason. A tax-loss harvesting strategy can help minimize your tax liability and keep more money in your pocket. However, trying to reduce taxes shouldn’t come at the expense of maintaining a thoughtful asset allocation in your portfolio.

3. Asset Location

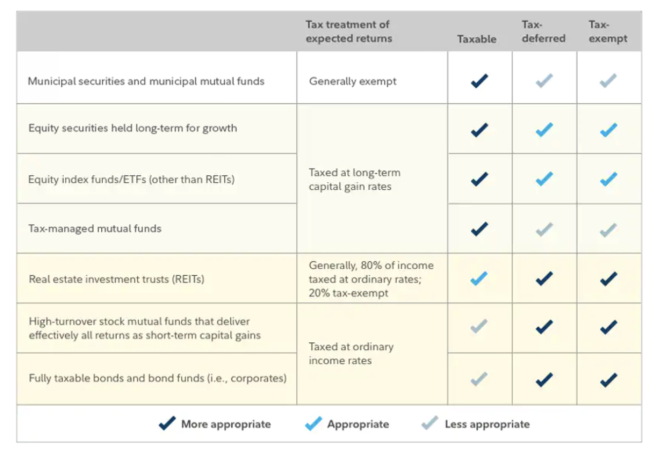

Some investments will be more tax-efficient than others. For example, a municipal bond is considered the most tax-efficient security because income from municipal bonds are federally tax-exempt and may be state tax-exempt. Investments like high-yield bonds are considered less tax-efficient because payments are not tax-exempt, meaning they are taxed as ordinary income. When looking at the table below, assets at the top are more tax-efficient than assets at the bottom.

Source: Fidelity

Like assets, there are investment accounts which are more tax-friendly. Tax-advantaged accounts allow you to defer paying taxes on the gains or earnings to a later date. For example, a traditional IRA or a 401(k) will allow you to contribute using pre-tax income and withdrawals are taxed when you retire, when your income is typically lower.

Pairing tax-advantaged accounts like a 401(k) with tax-inefficient assets like a high-yield bond and pairing taxable accounts (individual, joint, trust, etc.) with more tax-efficient assets will create a more optimal mix to minimize tax liability. Placing investments at higher tax rates with accounts that delay taxes will help reduce the amount you owe. Since you are not expected to pay federal taxes on something like income from a municipal bond, there is no use placing it in a tax-advantaged account because there are no taxes to delay.

Of course, this is a bit of an oversimplification as there are many nuances which can make certain investment vehicles more tax-efficient than others. For example, although REITs are toward the bottom of the table, there are still plenty of advantages to investing in them. Dividends from REITs are sheltered from corporate tax, and some dividends are considered a return of capital which means they are not taxed as income. This is why it is imperative to work with an experienced professional who can use the nuances of each financial instrument to your advantage.

4. Understand Cost Basis & Share Lots

When you buy any amount of stock, the stock is assigned a lot number regardless of the number of shares. If you have made multiple purchases of the same stock, each purchase is assigned to a different lot number with a different cost basis (determined by the price at the time of each purchase). Consequently, each lot will have appreciated or depreciated in different amounts. Some brokerage accounts use first in, first out (FIFO) by default. If you utilize FIFO, your oldest lots will be sold first. Sometimes FIFO makes sense, but not always. Sometimes it is ideal to sell lots with the highest cost basis, which is commonly done as part of a tax-loss harvesting strategy.

Passing on assets as an inheritance can also increase your cost basis. Assets passed on to the next generation at the time of death allow your heirs to pay tax only on capital gains which occur after they inherit your property, through a one-time “step up in basis.” For example, when one spouse dies, assets passed on to the surviving spouse will have a cost basis of the price of the asset on the day in which they passed. This eliminates the deceased spouse’s portion of capital gains.

We’re Can Help With Capital Gains Tax Strategies

At The Rosamond Financial Group, we know that your financial life is too important to leave in the hands of just anyone. Just as you wouldn’t want a plumber wiring the electricity in your new home, you don’t want generic advice guiding your wealth. With something as personal as your finances, you deserve specialized guidance tailored to your situation.

Whether you’re a corporate executive focused on maximizing your time and compensation, an affluent retiree navigating withdrawals and legacy planning, or a small business owner balancing growth and succession, we provide the personalized strategies you need to minimize stress and optimize outcomes.

Capital gains tax planning is only one piece of the larger financial puzzle. Our team takes the time to understand your unique challenges so we can craft a comprehensive, proactive plan—one that allows you to spend more time doing what you love while knowing your wealth is being managed with care.

Schedule a complimentary, no-obligation consultation by reaching out to us at 830-798-9400 or email solutions@rosamondfinancialgroup.com.

About Preston

Preston Rosamond is a financial advisor and the founder of The Rosamond Financial Group Wealth Management, LLC with over two decades of industry experience. He provides comprehensive wealth management and financial services to successful business owners, corporate executives, and affluent retirees who enjoy simplicity and seek a professional to help them pursue their goals. Preston personally serves his clients with an individual touch, a sincere heart, and his servant’s attitude is evident from the moment you meet him. Learn more about Preston or start the conversation about your finances with him by emailing solutions@rosamondfinancialgroup.com or schedule a call on his online calendar.